The trouble with trouble is that you can't always see it coming; things will be going along just fine, until they aren't. And then it's too late. And then you're in trouble.

I'll start this post off by admitting I really don't know for sure what to expect from the market this year. (it seems like I say that every year lately). But I do have some concerns about headwinds (I've been saying that for a couple-few years too).

Let's take a look at some current local and global economic trends to see if we can discern what we might have in store...

Market Momentum

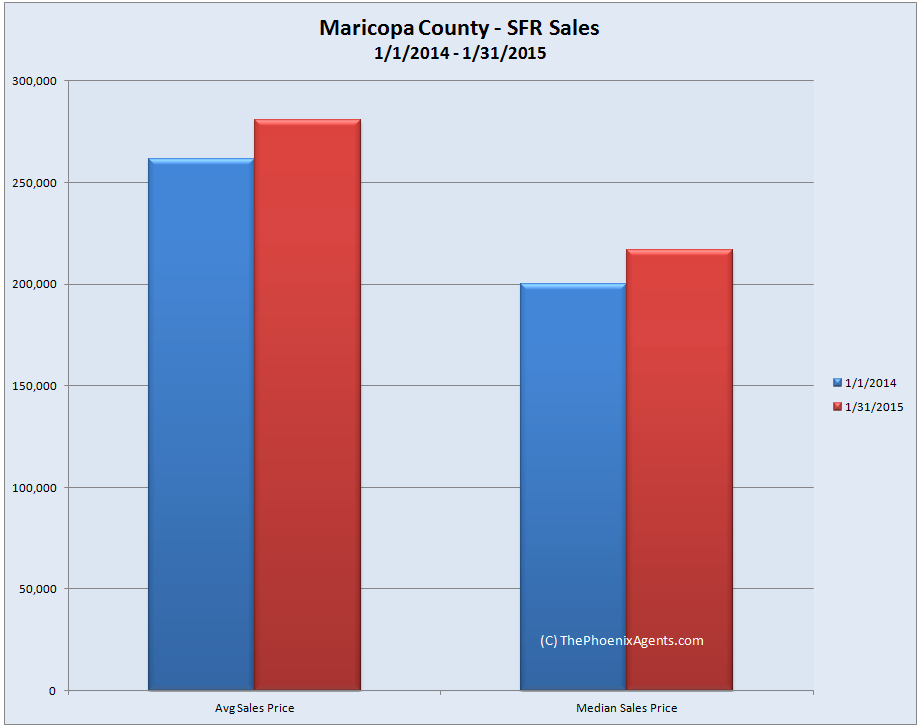

Local real estate prices are up about 10% - 15% over the last couple of years, or about 5% - 7% per year. That's a little too fast to be sustainable, but rising prices are generally considered a good thing. Buyers are more confident in their purchase, and even a little bit motivated to make an offer before prices go up again. Sellers gain confidence from knowing what they'll be able to net based on recent sales, as opposed to a falling market where sellers either panic or stay put.

(click on any chart or image to embiggen)

But, taking an objective approach, how much lower could they really go? Could we see a 30-year mortgage at 3.0%? 2.5%? Maybe. Rates have been close to zero in Japan for a generation, so there is a precedent. Unfortunately Japan has other problems which are offsetting, or forcing, those low interest rates, and none of those problems are conducive to a healthy real estate market.

On the flip side, it doesn't take much creativity to imagine a 30-year mortgage at 5% or 6%. And the difference?

A $300,000 house with a 20% down payment and an 80% loan ($240,000) will have a monthly mortgage payment of $1,111 at today's 3.75%. That same $1,111 payment could buy a $329,538 house if rates fall to 3.0%, but it can only purchase a $258,810 house if rates rise to 5.0%. (or $231,731 at 6.0%!) - see charts below.

Interest rates can have a massive impact on our market, and they have more room to rise than fall from where they are today.

Rising Dollar

Oil Prices

sales data provided by ARMLS and is deemed accurate but not guaranteed.

However, market momentum only goes so far. Momentum can be fickle, and when it changes it can change on a dime.

Interest Rates

Interest rates are low. Very low. All time, record setting, once in a lifetime low. I'm not going to predict rising rates this year - heck, rates might stay where they are for a long time. They might even drop lower.

Interest Rates

Interest rates are low. Very low. All time, record setting, once in a lifetime low. I'm not going to predict rising rates this year - heck, rates might stay where they are for a long time. They might even drop lower.

charts provided by the Federal Reserve Economic Data website

But, taking an objective approach, how much lower could they really go? Could we see a 30-year mortgage at 3.0%? 2.5%? Maybe. Rates have been close to zero in Japan for a generation, so there is a precedent. Unfortunately Japan has other problems which are offsetting, or forcing, those low interest rates, and none of those problems are conducive to a healthy real estate market.

On the flip side, it doesn't take much creativity to imagine a 30-year mortgage at 5% or 6%. And the difference?

A $300,000 house with a 20% down payment and an 80% loan ($240,000) will have a monthly mortgage payment of $1,111 at today's 3.75%. That same $1,111 payment could buy a $329,538 house if rates fall to 3.0%, but it can only purchase a $258,810 house if rates rise to 5.0%. (or $231,731 at 6.0%!) - see charts below.

Interest rates can have a massive impact on our market, and they have more room to rise than fall from where they are today.

Rising Dollar

I'm not smart enough to outline exactly why the Dollar is rising against foreign currencies - something to do with the coming economic problems in Europe and Japan being nearer to the forefront than the problems in the US, so globally people would prefer to hold Dollars rather than Euros or Yen, thinking the former is more likely to hold its value. And of course the price of a good or service (Dollars in this case) will increase with the rise in demand.

charts clipped from google finance

What does this mean for us? Here are is an over simplified example:

Let's say Apple is a US company and sells iPhones for $500. And let's say Samsung is a South Korean company who sells Galaxy phones for 500,000 Korean Won, which was about $500 last summer when $1 was worth 1,000 KRW. Competitive products with competitive pricing.

However, since the US Dollar is now up about 10% compared with the Korean Won ($1 is now worth 1,100 KRW), the competitive landscape has changed. In order for Apple to earn $500 on an iPhone in South Korea, they need to charge 550,000 Won, which makes their product more expensive than the South Korean local product, which is likely to negatively impact Apple's sales. OR, Apple can continue to charge 500,000 Won for an iPhone, but that only equates to $455, which negatively affects their profits. Either way, Apple loses in Korea.

On the other hand, Samsung can now sell its Galaxy phones for $455 in the US and earn the same 500,000 Won, or they can keep the price at $500 in the US and earn 550,000 Won for each phone. They'll either sell more phones at a lower price or earn more profit on each phone sold. Either way, Samsung wins in the US.

Apple is now earning less money on their phones sold overseas, and they're facing increased competition from overseas manufacturers here at home. This is likely to have a negative impact on Apple's financials, at least in the short term. This makes Apple less likely to add new jobs, build new factories, open new stores, etc. And that's for one of the strongest companies in the world. Weaker companies may be forced to lay-off employees and close stores.

This will be true for every company in every industry who either sells products overseas, or who competes in an industry with foreign companies. (Namely, just about every company in America!) General Motors, General Electric, Intel, Proctor & Gamble, Microsoft, Apple, Ford, Coca Cola, Pepsi, Caterpillar, Johnson & Johnson, etc. etc. etc., just to name a few.

I don't see upward pressure on wages in a market where every American company is facing increased pricing pressure from foreign competitors. And I don't see upward pressure on housing prices without upward pressure on wages...

Oil Prices

Gas prices have been awesome lately, and I loved filling up my tank for less than $20 a couple weeks ago. I think lower gas prices would help the real estate economy if these new prices were here to stay, and we could all count on spending less at the pump each month. Folks would have more discretionary income to spend, which they might funnel back into a mortgage payment, or they would feel better about buying out in the suburbs and commuting a little further.

Unfortunately, history isn't on our side. Here is a 10-year look at gas prices, and we're currently near the very bottom of the chart. The other side of the coin, with gas prices near $4 per gallon, seems just as likely as today's sub-$2 gas, and that would have a dampening effect on our home prices.

source: gasbuddy.com

"Typical Family Moves"

I've been saying this for years now, but the one thing missing from our real estate market is the one thing that was a staple of our market for decades: people moving locally from one house to another - either to a larger home, or a better neighborhood, or a different school district. For decades this was a staple of the Phoenix area market, and it has all but disappeared. Forget what I'm seeing in "the market", think about your own personal life - how many people do you know who have moved in the last year just because they wanted to, and not because of some other external factor (divorce, job change, family crises, etc.) I bet you can't name more than a couple..

I've been saying this for years now, but the one thing missing from our real estate market is the one thing that was a staple of our market for decades: people moving locally from one house to another - either to a larger home, or a better neighborhood, or a different school district. For decades this was a staple of the Phoenix area market, and it has all but disappeared. Forget what I'm seeing in "the market", think about your own personal life - how many people do you know who have moved in the last year just because they wanted to, and not because of some other external factor (divorce, job change, family crises, etc.) I bet you can't name more than a couple..

Someday people will move again more freely, but right now that isn't a significant part of our market, and I don't see that changing this year.

In the End

I'm not here to say prices are too high, or too low, or to make any other bold predictions. Right now people are selling houses and others are buying them, so whatever price they agreed to must be fair. Unfortunately I'm seeing a market which still hasn't fully recovered from the collapse in 2008, along with a macro-economic environment which has more potentials for bad news than good. If I had to pick a direction, I might lean towards a slower market later this year.

I'm not here to say prices are too high, or too low, or to make any other bold predictions. Right now people are selling houses and others are buying them, so whatever price they agreed to must be fair. Unfortunately I'm seeing a market which still hasn't fully recovered from the collapse in 2008, along with a macro-economic environment which has more potentials for bad news than good. If I had to pick a direction, I might lean towards a slower market later this year.

Buyers - now is a great time to lock in a historically low interest rate. Your monthly payment could still be lower than it would be if prices drop but interest rates increase.

Sellers - now may be a great time to take advantage of a market where there are plenty of buyers using low interest rate loans and an upward trend in pricing.

But in either case, you'll want to do what makes sense for you and your family. Buying probably isn't a great idea if you're unsure about your job security, or if you'll need to move again in a couple years. Selling won't work if you don't have another place to live that meets your needs.

Bottom line is we really don't know what is going to happen this year. Your best bet is to think about an optimistic and a pessimistic scenario, and weigh your decisions accordingly.

- Chris Butterworth

.